Why the property rebound is inevitable

Australia's supply and demand fundamentals remain strong. Lead indicators suggest once interest rates settle, a property market rebound will likely be swift.

Current property price corrections are primarily related to market realignment with higher interest rates and the subsequent reduction in people’s borrowing capacity.

Secondary to this, fear of inflation and the extent to which interest rates will rise is negatively impacting sentiment and weighing on the market. Anecdotally many potential purchasers are subsequently adopting a “wait and see” approach.

Despite these factors, demand for property remains exceptionally high and is set against very low levels of supply.

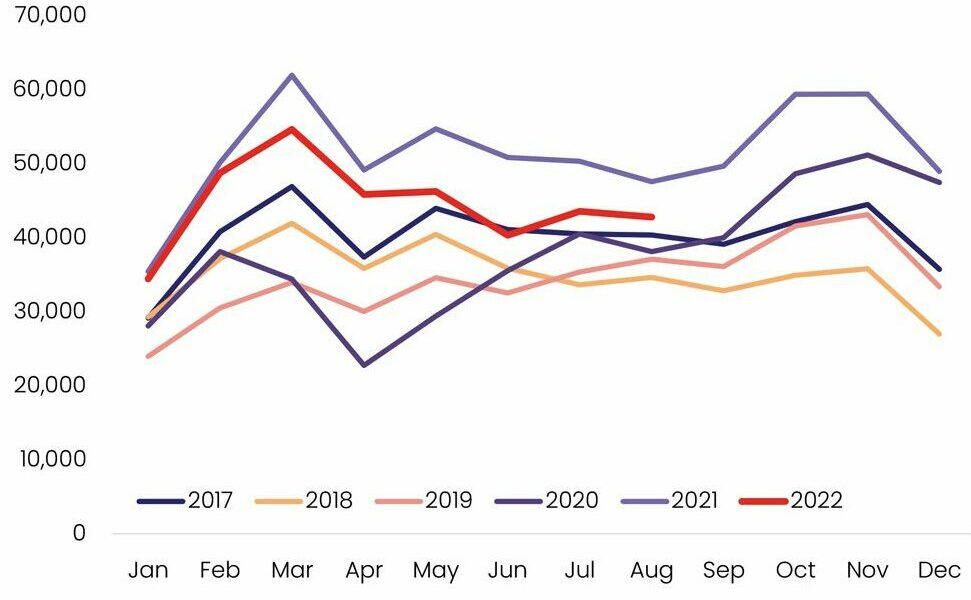

- Demand reflected by the number of property sales may be lower than last year, but it remains seasonally higher than at any other time during the previous four years.

DWELLING SALES- NATIONAL

(Source: Corelogic)

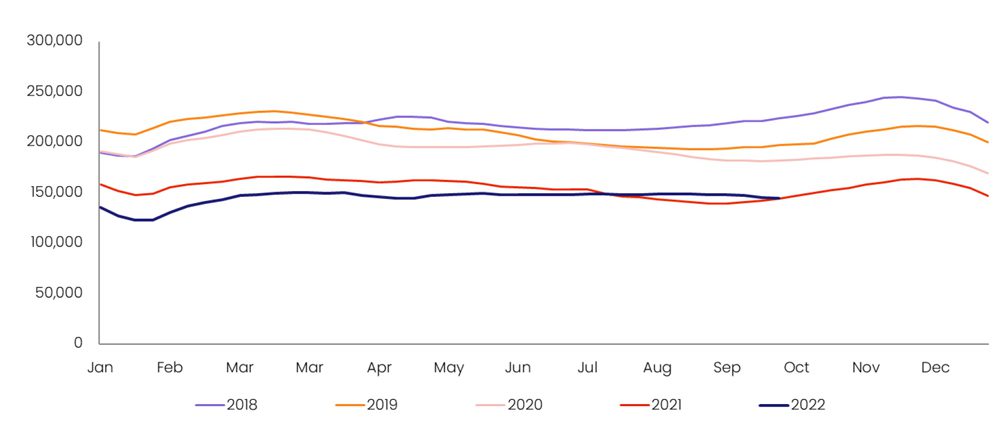

- The total supply available is on par with last year and lower than any other time in the prior four years.

FOR SALE LISTINGS- NATIONAL

(Source: Corelogic

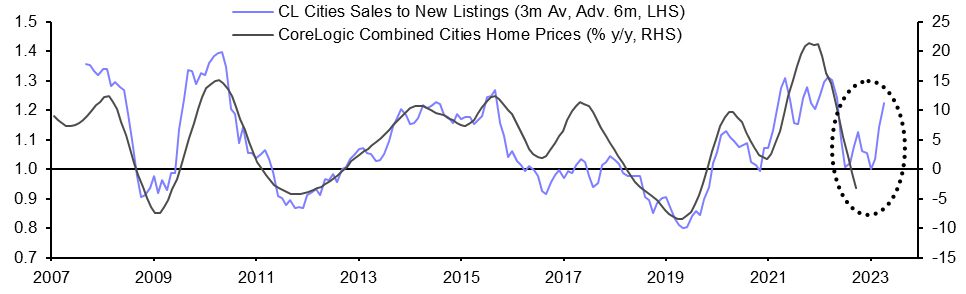

- Furthermore, the sales to new listings ratio, which is a strong lead indicator of price growth, now suggest a potential market turnaround.

SALES TO NEW LISTINGS RATIO LEADS DWELLING PRICES

(Source: Capital Economics)

With an exceptionally strong demand/supply balance still at play, and additional pressures building (rapidly increasing migration/ a drastically insufficient future supply pipeline), a strong market recovery seems all but inevitable as soon as inflation comes under control and interest rates stabilise. And this appears to be not all that far away.

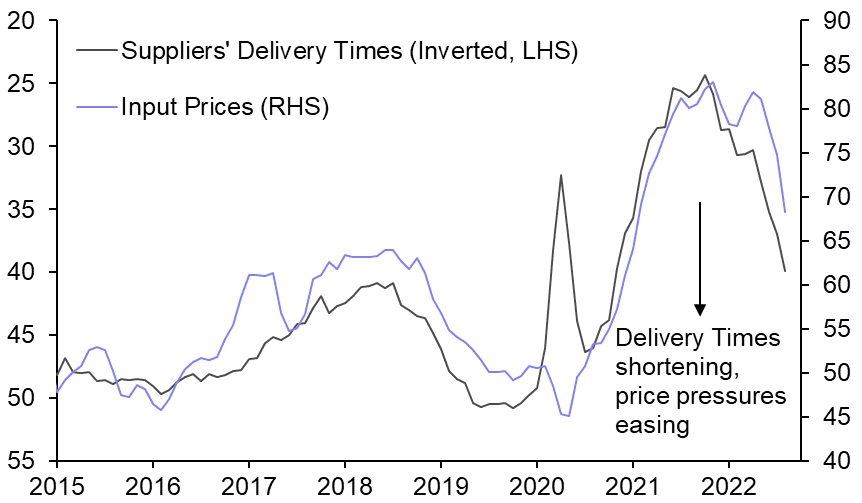

- Regarding inflation, supply pressures, input prices and shipping rates have been easing for quite some time. In fact, in the US, inflation has already peaked and recorded declines for the previous 4 months.

SUPPLY DELIVERY TIMES AND INPUT PRICES

(Source: Capital Economics)

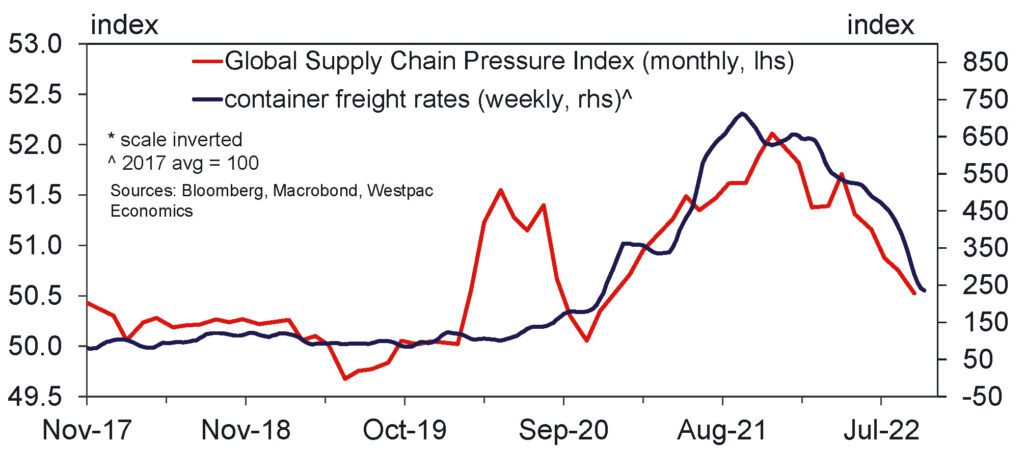

SUPPLY CHAIN PRESSURES INDEX & SHIPPING RATES

(Source: Westpac)

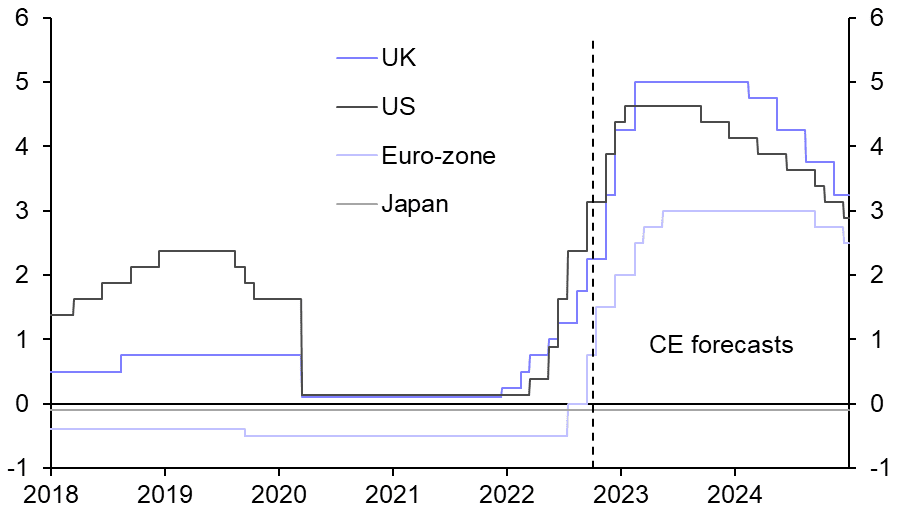

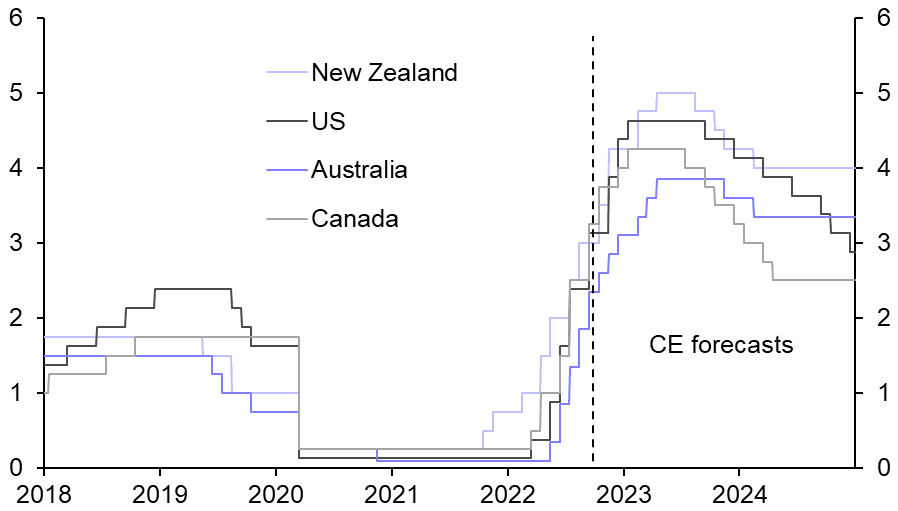

- It is now widely accepted that interest rates will peak in the new year and be followed by a pivot to interest rate cuts. Furthermore, the interest rate peak in Australia is anticipated to be one of the lowest amongst advanced economies.

OFFICIAL INTEREST RATE FORECASTS- CAPITAL ECONOMICS

(Source: Capital Economics)

Once interest rates settle, the property market turnaround will likely be swift, as buyers who have been delaying purchases due to uncertainty or an attempt to “time the market” pile back in and compete for a limited number of available properties.