Supply falling short of the growing preference for apartment living

At the time of the 1991 Census, around 14% of Australian households lived in apartments. By the 2016 Census, that proportion had increased to 20% of households. When the most recent 2021 Census data is released, it can be expected that this number will have increased dramatically.

This increasing trend towards apartment living can also be demonstrated by the rising number of apartments as a percentage of total new dwelling completions.

APARTMENTS AS A PROPORTION OF ALL NEW DWELLING COMPLETIONS- AUSTRALIA

Source: ABS

Average apartment proportion for select time periods:

- 1955-1960: 4.4%

- 1980’s: 22%

- 1990s: 26%

- 2000’s: 30%

- 2010’s 39%

- Previous 5yrs 44%

The historical trend of a reduction in the average Australian household size and an increase in lone-person households has likely played a large part in the greater adoption of high-density living.

The average Australian household size has fallen by around two persons per dwelling during the last 100 years, from around 4.6, to an average of 2.6 recorded at the time of the 2016 Census.

According to the RBA, a reduction in the average number of people per household as a result of the COVID-19 pandemic was significant enough to create housing demand in excess of that which was lost to the pause in international migration.

AVERAGE AUSTRALIAN HOUSEHOLD SIZE

Source: Australian institute for family studies

In alignment with the reduction in household size, the number of lone persons households in Australia has risen substantially.

Just after WWII, persons living alone fell to a low point of around 8% of Australian households, since then the proportion of people residing alone has risen to make up 25% of households.

AUSTRALIAN LONE PERSON HOUSEHOLDS

Source: Australian institute for family studies

Wider adoption of apartment living is also being attributed to changing life stage choices and lifestyle preferences among younger generations and the downsizer demographic.

According to a 2020 report from the Strata Community Association and UNSW 50% of apartment residents are aged between 20-39 years, and 20% are aged 40-59. The remaining 30% of apartment residents are split equally between those under 20 and those 60+.

Apartment household composition was reported to be made up of:

- Lone persons 35%

- Couples 24%

- Couples with children 13%

- Groups 9%

- Single parent families 6%

Through both choice and necessity apartment living is becoming an ever more appealing option for many Australian households.

Location and affordability are two of the most fundamental drivers informing these decisions.

People are more inclined to choose an apartment over traditional housing in order to live where they most desire, and increasingly apartment living is being seen as the only viable choice for some.

The disparity between house and apartment prices in Brisbane is now the widest it has been during the past two decades.

During the 13 years prior to 2016, the average price gap between houses and units was 16%, as of December 2021 houses were 70% more expensive than apartments according to the ABS.

BRISBANE MEDIAN HOUSE PRICE VS APARTMENT PRICE

Source: ABS

This price disparity is now driving an even greater shift toward apartment demand.

Realestate.com recently reported that enquiry on detached housing and vacant land has slipped 4.4% and 5.1%, respectively, while apartment searches have soared 16.6% year-on-year.

Regardless of any underlying demand or fundamental necessity for higher density living options, however, the ability for a supply response is often inelastic.

There are significant hurdles and constraints to apartment project delivery, both inherent and artificial, and especially when considered relative to the ability to deliver freestanding dwellings.

This is demonstrated by the sharp fall in the number of apartment completions in Queensland since 2017.

The SEQ Regional Plan 2017 specifies housing development targets of 60% infill (apartments) versus 40% greenfield (house and land).

Despite this, the average proportion of apartment completions as a percentage of new dwellings in Queensland over the past five years has only been 38%, while the number of apartment completions across the state in March 2021 was the lowest in a decade.

APARTMENTS AS A PROPORTION OF ALL NEW DWELLING COMPLETIONS- QUEENSLAND

(Source: ABS)

In part, this is a result of mounting challenges which are impacting residential apartment project viability and delivery including:

- Restrictions and disincentives for foreign investment

- Local community resistance

- Town planning changes such as increased parking requirements, reduced site cover allowances and “townhouse bans”

- Severe and rapid construction cost inflation

- Limited builder availability and reliability

- Construction funding availability and parameters

The falling number of apartment completions at a time when Queensland population growth is skyrocketing is a major contributing factor to the current rental crisis, and part of the reason why SEQ regions are experiencing the tightest vacancy rates and most significant rental increases in the country.

Astoundingly it is now more expensive to rent in Brisbane than in Melbourne according to Domain and SQM Research.

The UDIA recently reported that annual SEQ apartment completions were down 22% during 2021, while the number of new unit sales was up 93% for the year.

Despite the increase in unit sales, the number of unit approvals for the year fell 5%.

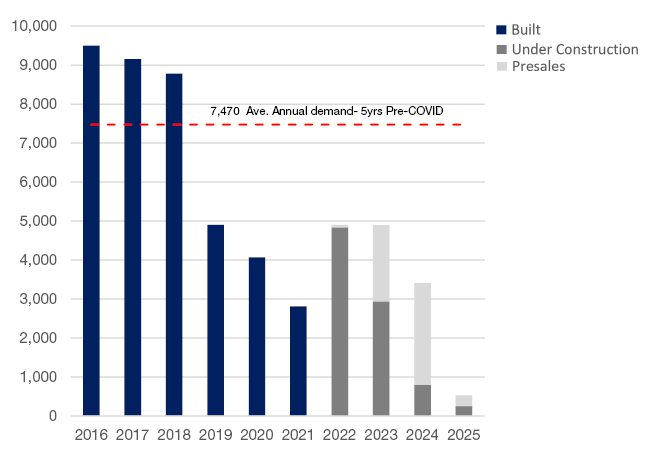

Based on historical demand and likely anticipated supply, SEQ will experience a shortfall of more than 16,500 new apartments over the next 4 years.

INNER BRISBANE, GOLD COAST & SUNSHINE COAST POTENTIAL APARTMENT SETTLEMENTS

(Source: CoreLogic, JLL, Place Advisory, PriceFinder)

All the factors outlined above are now culminating to support SEQ apartment pricing and drive robust growth at a time when the freestanding housing market is slowing.

Brisbane apartment prices have been increasing for the previous 21 months and have risen 22.2%. They passed pre-pandemic levels in January 2021 and have risen 16.8% in the previous year.

While the monthly rate of Brisbane house price growth has been easing off, monthly apartment price growth remains strong.

According to CoreLogic, During May 2022 Brisbane apartment growth of 1.2% outperformed free-standing house price growth of 0.8%

BRISBANE APARTMENT PRICES SINCE COVID-19

(Source: Corelogic)