Demand and Supply Imbalance – the Key to Individual Property Performance

Mosaic has compiled a detailed report unravelling the current demand and supply issues and the impact on individual property performance within micro-market locations. Continue reading more below.

Property markets are influenced by an endless number of complex interplaying factors. Essentially though, property market trends all boil down to how these variables impact demand and supply. However, what is most critical in terms of market outcomes is not the absolute levels of demand and supply that result but rather the disparity between the two. Fundamentally the balance between demand and supply is what ultimately determines market pricing movements. Effectively, regardless of how high or low either is, if demand exceeds supply prices will rise and vice versa.

Further to this, what is critical to note is that this law of demand and supply operates independently across innumerable sub-markets differentiated by property type and location. Although broad macroeconomic and demographic influences may impact the property market as a whole, outcomes will never be uniform across all market segments. The extent and even direction of influence over demand and supply and the resulting balance between the two will not be consistent across all locations and product types.

In the face of rising interest rates and inflation, the SEQ apartment markets remain resilient and will undoubtedly experience sustained growth across various micro-market locations and product types over the short to medium term. Over the medium to longer-term, underlying demand and supply fundamentals indicate that it is only a matter of time until above-average rates of growth return.

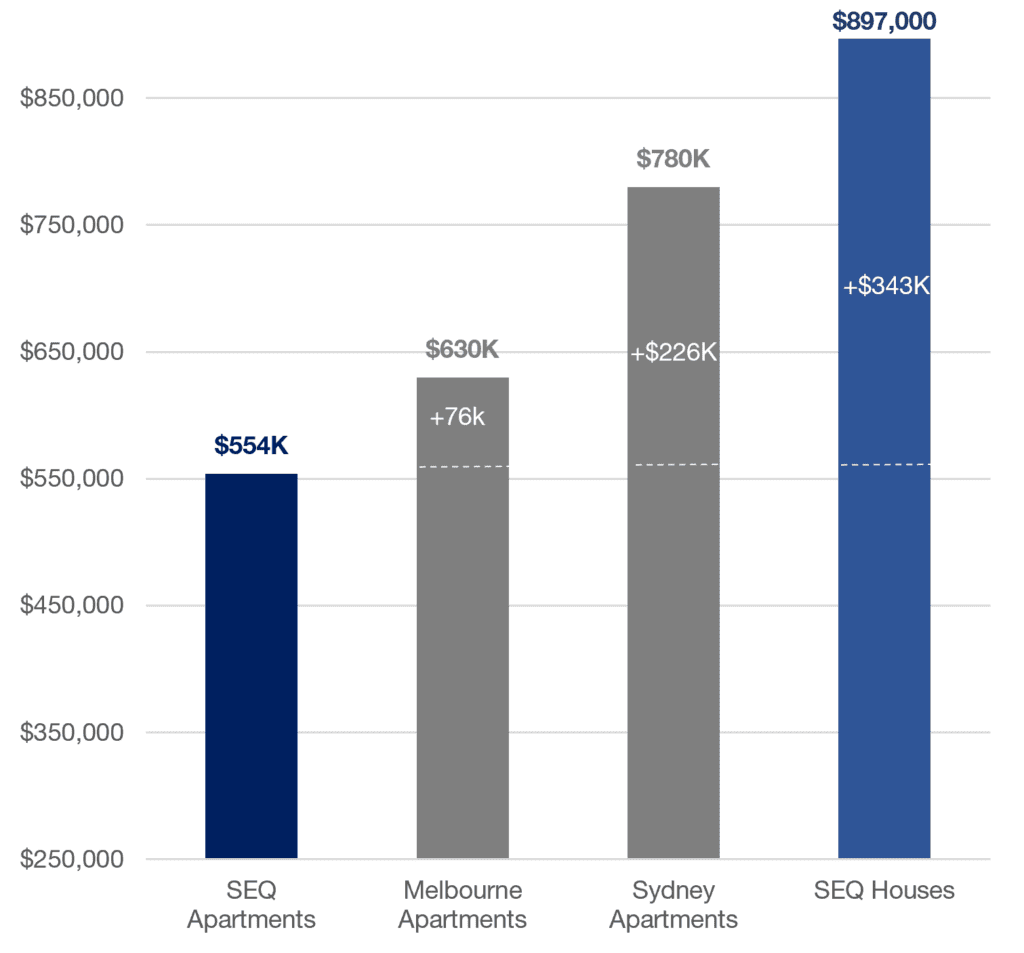

In respect of overall demand, the relative affordability of the SEQ market and more specifically that of apartments is the most important factor currently supporting demand. Melbourne and Sydney’s apartments are around 14% and 41% more expensive than SEQ apartments, while SEQ houses are around 62% more expensive than SEQ apartments.

SEQ Apartment Price Comparison – 2022 FY

Source: Pricefinder

These price differentials provide an attractive proposition for aspiring purchasers while also making the SEQ apartment markets less susceptible to any reduced borrowing capacity brought about by interest rate rises. In some instances, rising interest rates will even be responsible for a rise in demand; for example, when purchasers opt for apartments in circumstances where they no longer have the capacity to purchase from the freestanding dwelling market in their desired location.

Over the medium to longer term, demographic trends and the strongest forecast population growth in the country will be the key drivers of increasing apartment demand within SEQ. More importantly, rising apartment demand will be set against a severe lack of current and future supply in both absolute and relative terms.

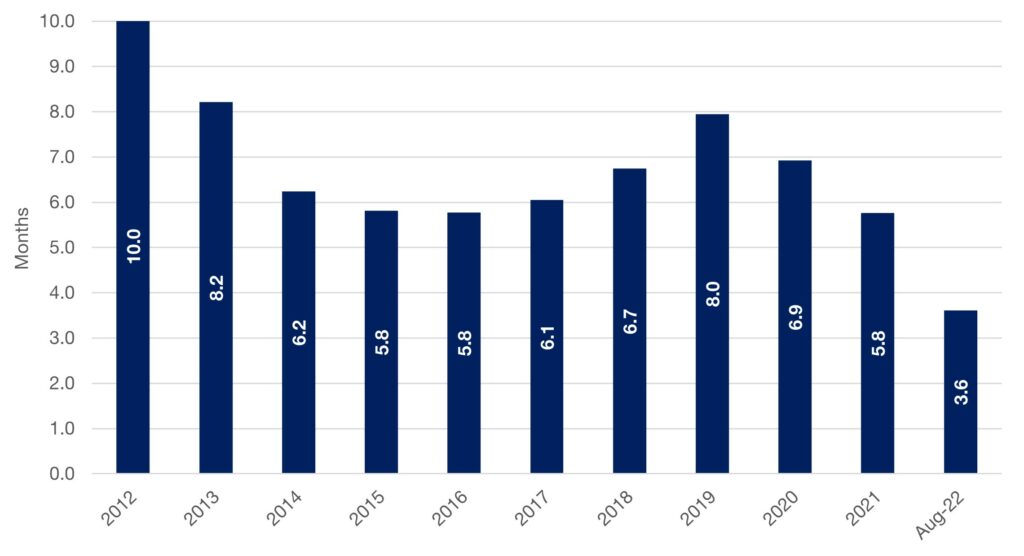

In current overall terms, SEQ housing demand as reflected by sales volumes over the previous year is 26% above the previous 10-year average, whereas supply measured by current housing stock on market is 30% below the previous 10-year average. This is indicative of the lowest levels of housing supply relative to demand in more than a decade. At the present average rate of sales, current stock on market is equivalent to only 3.6 months’ worth of supply.

Months Worth of Housing Supply on Market – Brisbane, Gold Coast & Sunshine Coast

Source: SQM Research

More specifically in regard to the SEQ apartment markets, there is only 3.2 months’ worth of new supply available. Based on historical sales and potential future supply, there is estimated to be a shortfall of more than 16,000 new apartments during the next four years.

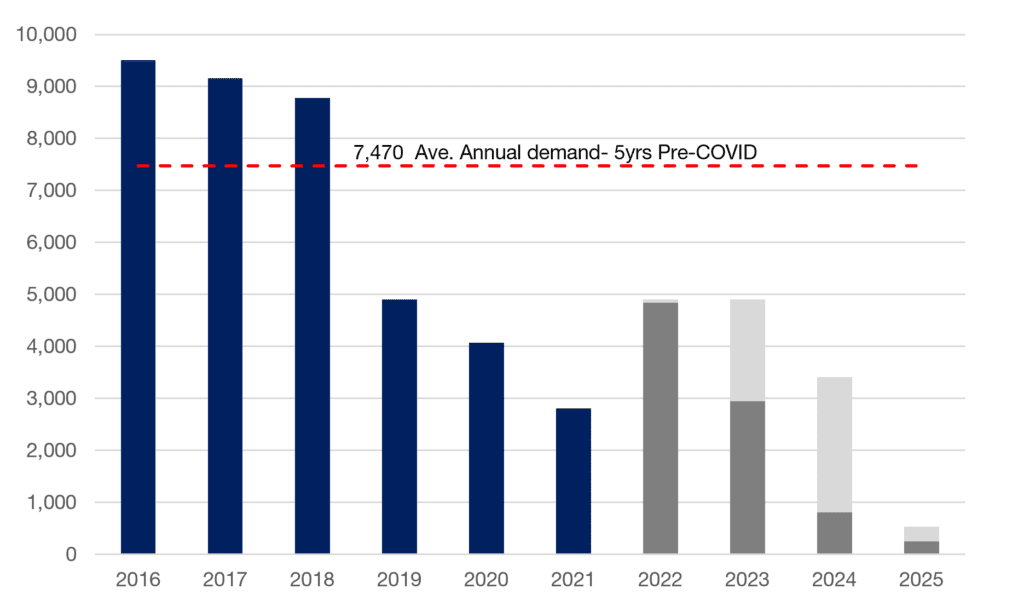

Given the current challenges facing supply delivery including labour and material shortages, record construction cost inflation, builder insolvencies and project funding challenges, the undersupply could blow out to a shortfall of more than 21,000. Master Builders Queensland has already reported that over a billion dollars worth of projects has been officially cancelled or put on hold, with billions more anticipated to follow.

Inner Brisbane, Gold Coast & Sunshine Coast Potential New Apartment Supply

Source: Corelogic, JLL, Place Advisory, Pricefinder

For inner Brisbane, the apartment undersupply situation is even more acute. With 94% of active projects sold out, Urbis and Place advisory report that inner Brisbane only has a further 2 months’ worth of new apartment supply available.

In terms of future supply, there are currently only around 4,000 apartments with reasonable likelihood of being delivered over the next four years or an average of 1,000 units per annum. To put this in perspective, historical demand as reflected by previous sales rates was 5,300 apartments per annum during the four years prior to the pandemic.

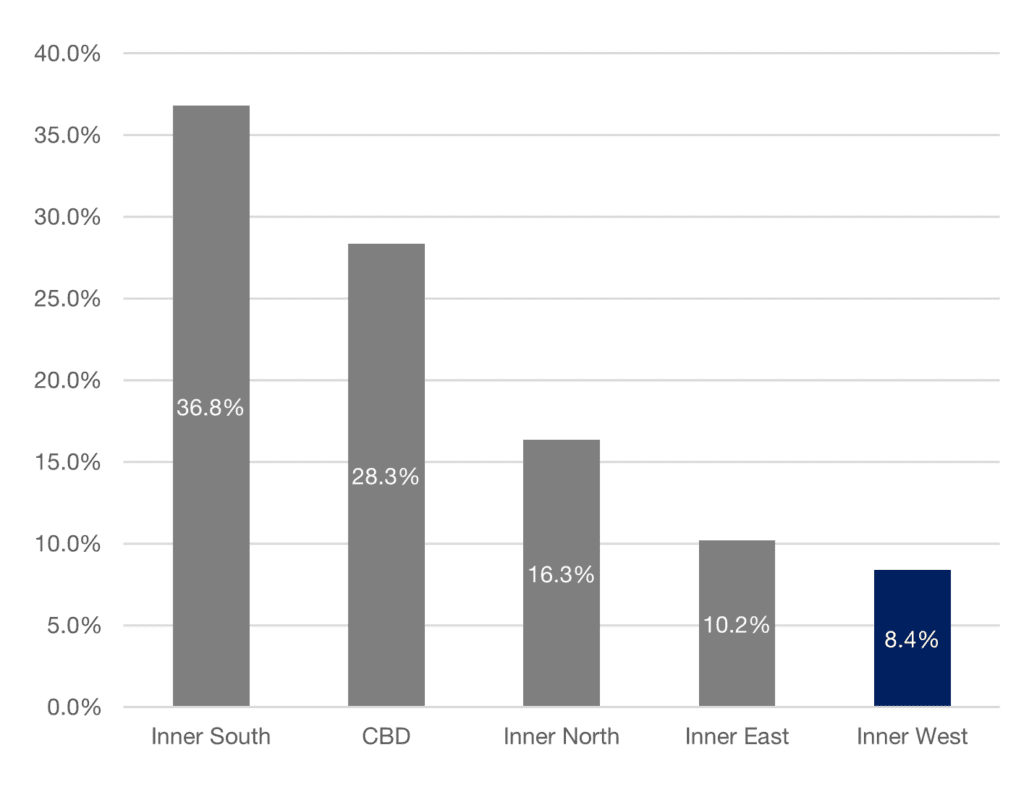

Examining future undersupply in greater micro-locational detail, only 8.4% of the drastically insufficient apartment pipeline is to be delivered to the city’s inner west where the majority of Mosaic’s Brisbane projects have been located in recent years. This precinct includes the suburb of Milton where Mosaic’s most recent project The Manning has been released.

At the other end of the scale, the inner south will receive the bulk of future supply, accounting for around 37%. Place Advisory reports the suburbs of South Brisbane, Woolloongabba, and Kangaroo Point will receive the majority of incoming supply.

Distribution of Potential Inner Brisbane Apartment Supply

Source: JLL

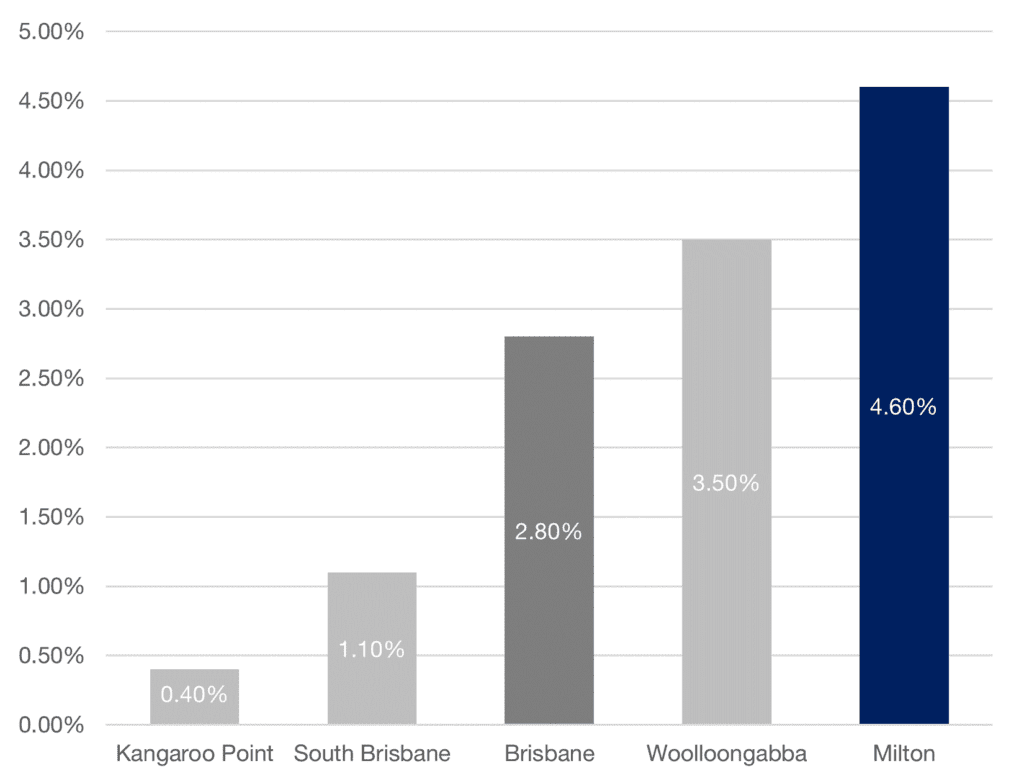

Locational differences in the extent of demand-supply imbalance are already apparent in divergent rates of recent apartment price growth across the aforementioned suburbs and illustrate how varying degrees of demand and supply disparity within separate micro-markets lead to both under and outperforming the wider market norm. While the Brisbane apartment market collectively rose in value by 2.8% during the past 3 months, suburbs like South Brisbane increased by less than half that amount, while Milton for example achieved substantially higher growth of 4.6%.

Previous 3 Months Apartment Price Growth

Source: Pricefinder

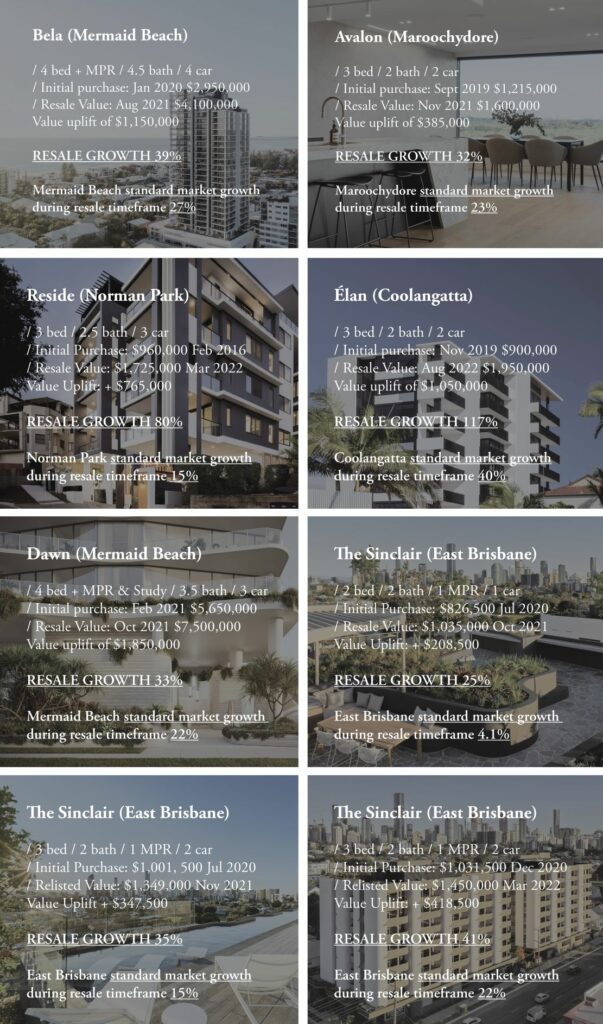

Breaking this down further, individual property performance within micro-market locations illustrates how the law of demand and supply also operates at a property type level. In the most favourable examples of this, excessive demand-supply imbalance for limited but highly sought-after property types within a micro-market location can lead to notable outperformance of the standard market norm as illustrated by the following Mosaic resales.

*Suburb price growth calculated on rolling 6-month median value