Financial Health Check Part 2 – Avoiding Mortgage Insurance AND Getting Into A Property Sooner

PART 2 – AVOIDING MORTGAGE INSURANCE AND GETTING INTO A PROPERTY SOONER

Many lenders now recognise the difficulty that some younger people face in entering the property market and have developed loan products to assist.

A significant advancement in recent years is “limited guarantees”. This involves family assistance which enables a close relative to provide a security guarantee on the purchase of a home.

A limited guarantee is just that…

limited to a certain amount.

So how does it work?

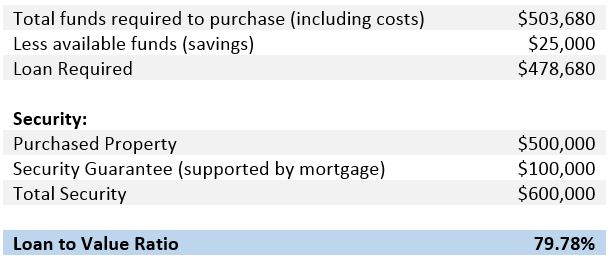

Let’s say you want to buy your first home for $500,000 and have savings of $25,000 but don’t want to pay around $17,000 in mortgage insurance (required for a loan to value ratio of less than 80%). Let’s also say that Mum and Dad have offered you some assistance and they own or have sufficient equity in their own property.

Here’s what can happen:

Under this scenario the purchasers now have a loan to value ratio of less than 80% which has saved them around $17,000 in mortgage insurance and probably years in rent. The loan can even be split into the main loan and the guaranteed loan. You can even have a shorter term for the guaranteed loan to get Mum and Dad out of the picture quicker.

Now everyone’s family circumstances are different so this scenario will not suit all families, however, for those that it does suit it’s a great way for Mum and Dad to help out without actually having to dig into their cash resources. To find out more about how this type of facility can help you (or your children) register below for a free review.

Want to check out the best loans for buying your first home? Get our FREE App here.

To book an appointment, find out more information, or to receive a copy of Portfolio Capital’s First Home Buyers’ Guide, please register your interest below.

Find all of the blogs in the Financial Health Check series here!

Please note that the example above is for information purposes only and should not be taken as financial advice. No account has been taken of the availability (or otherwise) of First Home Owners’ Grants or individual circumstances. The guarantees referred to are for security purposes only. Guarantees for assisting with payments are not available.

Disclaimer: This article is of a general nature and for information only. It should not be taken as financial or credit advice.